START-UP INDIA

1) Start-up India

Start-up

India

campaign is based on an action plan

aimed at promoting bank financing for start-up ventures to boost

entrepreneurship and encourage start-ups with jobs creation. The campaign was

first announced by Prime Minister Narendra Modi in his 15 August 2015 address

from the Red Fort. It is focused on to restrict role of States in policy domain

and to get rid of "license raj and hindrances like in land permissions,

foreign investment proposal, environmental clearances. It was organized by

Department of Industrial Policy and Promotion (DIPP). A start- up is an entity

that is headquartered in India which was opened less than five years ago and

has an annual turnover less than Rs. 25 crore (US$3.7 million). The government

has already launched iMADE, an app development platform aimed at producing

1,000,000 apps and PMMY, the MUDRA Bank, a new institution set up for

development and refinancing activities relating to micro units with a refinance

Fund of Rs. 200 billion (US$3.0 billion).

The

Stand-up India initiative is also aimed at promoting entrepreneurship among

SCs/STs, women communities. Rural India's version of Start-up India was named

the Deen Dayal Upadhyay Swaniyojan Yojana. To endorse the campaign, the first

magazine for start- ups in India, The Cofounder, was launched in 2016.

Key Points

·

Single Window Clearance even with

the help of a mobile application

·

10,000 crore fund of funds

·

80% reduction in patent registration

fee

·

Modified and more friendly

Bankruptcy Code to ensure 90-day exit window

·

Freedom from mystifying inspections

for 3 years

·

Freedom from Capital Gain Tax for 3

years

·

Freedom from tax in profits for 3

years

·

Eliminating red tape

·

Self-certification compliance

·

Innovation hub under Atal Innovation

Mission

·

Starting with 5 lakh schools to

target 10 lakh children for innovation programme

·

New schemes to provide IPR

protection to start-ups and new firms

·

Encourage entrepreneurship.

·

Stand India across the world as a

start-up hub

Government Role

The

Ministry of Human Resource Development and the Department of Science and

Technology have agreed to partner in an initiative to set up over 75 such

start-up support hubs in the National Institutes of Technology (NITs), the

Indian Institutes of Information Technology (IIITs), the Indian Institutes of

Science Education and Research (IISERs) and National Institutes of

Pharmaceutical Education and Research (NIPERs). The Reserve Bank of India said

it will take steps to help improve the ???ease of doing businesses in the

country and contribute to an ecosystem that is conducive for the growth of

start-up businesses

Action Plan

Start-up

India:

The Prime Minister of India, Shri

Narendra Modi had this year in his Independence Day speech announced the

???Start-up India??? initiative. This initiative aims at fostering

entrepreneurship and promoting innovation by creating an ecosystem that is

conducive for growth of Start-ups. The objective is that India must become a

nation of job creators instead of being a nation of job seekers. The Prime

Minister of India will formally launch the initiative on January 16, 2016

from Vigyan Bhawan, New Delhi. The event will be attended by a vast number of

young Indian entrepreneurs (over 2000) who have embarked on the journey of

entrepreneurship through Start-ups.

As a key component of this ???Start-up India??? launch, Government of India is organizing a global workshop on ???Innovation and Start-ups??? on January 16, 2016 . Shri Narendra Modi, Prime Minister of India will be the Chief Guest on the occasion. This workshop aims to provide a platform to bring together all stakeholders, stimulate dialogue on key challenges that the Indian innovation ecosystem currently faces, and provide the potential solutions to address them. Fostering a fruitful culture of innovation in the country is a long and important journey. This initiative will go a significant way in reiterating Government of India???s commitment to making India the hub of innovation, design and Start-ups.

START-UP INDIA

2) Steps to Starting

a Business

Starting a business involves planning, making key

financial decisions and completing a series of legal activities. These 10 easy

steps can help you plan, prepare and manage your business. Click on the links

to learn more.

Step 1: Write a Business Plan

Use these tools and resources to create a

business plan. This written guide will help you map out how you will start and

run your business successfully.

·

Define

your vision:

What will be the end result of your business?

·

Define

your mission:

Different to a vision, your mission should explain the reason your company

exists.

·

Define

your objectives:

What are you going to do -- what are your goals -- that will lead to the

accomplishment of your mission and your vision?

·

Outline

your basic strategies:

How are you going to achieve the objectives you just

bulleted?

·

Write a

simple action plan:

Bullet out the smaller task-oriented actions required

to achieve the stated objectives.

Step 2: Get Business Assistance and

Training

Take advantage of free training and counselling

services, from preparing a business plan and securing financing, to expanding

or relocating a business.

Step 3: Choose a Business Location

Get advice on how to select a customer-friendly

location and comply with zoning laws.

Step 4: Finance Your Business

Find government backed loans, venture capital and

research grants to help you get started.

Step 5: Determine the Legal Structure of

Your Business

Decide which form of ownership is best for you:

sole proprietorship, partnership, Limited Liability Company (LLC), corporation,

S corporation, non-profit or cooperative.

Step 6: Register a Business Name

("Doing Business As")

Register your business name with your state

government.

Learn which tax identification number you'll need

to obtain from the IRS and your state revenue agency.

Step 7: Register for State and Local Taxes

Register with your state to obtain a tax

identification number, workers' compensation, unemployment and disability

insurance.

Step 8: Obtain Business Licenses and

Permits

Get a list of federal, state and local licenses

and permits required for your business.

Step 9: Understand Employer

Responsibilities

Learn the legal steps you need to take to hire

employees.

Step 10: Find Local Assistance

Contact your local SBA office to learn more about how SBA can help.

START-UP INDIA

3) Start-up Resources

There are a number of available programs

to assist start-ups, micro businesses, and underserved or disadvantaged groups.

The following resources provide information to help specialized audiences start

their own businesses.

·

Environmentally-Friendly

"Green" Business

·

Home-Based

Business

·

Online

Business

·

Self-Employment

·

Minority

Owned Business

·

Veteran

Owned Business

·

Woman

Owned Business

You can save money when starting or

expanding your business by using government surplus. From commercial real

estate and cars, to furniture, computers and office equipment, find what you

need for your business in one place any entrepreneurs were excited by the

announcements made by Prime Minister Narendra Modi as part of the start-up

India Action Plan. There is no doubt the measures were significant, but they do

beg the question, are all the start-ups really eligible for the benefits that

were announced?

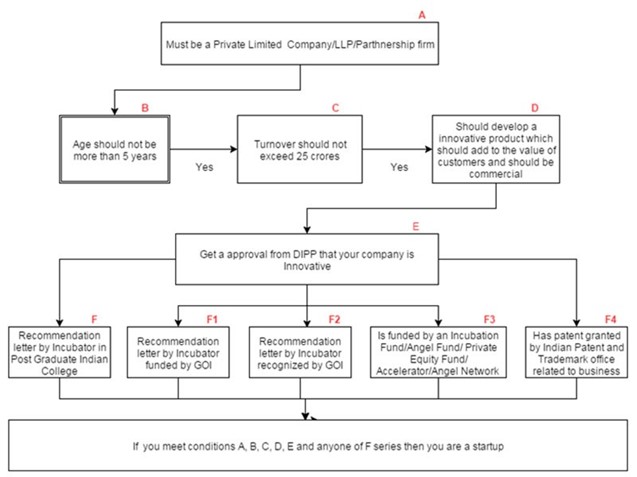

Here is a quick analysis of the eligibility

criteria

(please note that the following flow chart is specifically

applicable for start-ups seeking tax exemption):

In addition, for a start-up to be

recognized as one,

1.

It

must be an entity registered/incorporated as a:

o

Private Limited

Company under the Companies Act, 2013; or

o

Registered

Partnership firm under the Indian Partnership Act, 1932; or

o

Limited Liability

Partnership under the Limited Liability Partnership Act, 2008.

2.

Five

years must not have elapsed from the date of incorporation/registration.

3.

Annual

turnover (as defined in the Companies Act, 2013) in any preceding financial

year must not exceed Rs. 25 crore.

4.

Start-up

must be working towards innovation, development, deployment or

commercialisation of new products, processes or services driven by technology

or intellectual property.

5.

The

start-up must aim to develop and commercialise:

o

a new product or

service or process; or

o

a significantly

improved existing product or service or process that will create or add value

for customers or workflow.

6.

The

start-up must not merely be engaged in:

o

developing

products or services or processes which do not have potential for

commercialisation; or

o

undifferentiated

products or services or processes; or

o

products or

services or processes with no or limited incremental value for customers or

workflow

7.

The

start-up must not be formed by splitting up, or reconstruction, of a business

already in existence.

8.

The

start-up has obtained certification from the Inter-Ministerial Board, setup by DIPP

to validate the innovative nature of the business, and

o

be supported by a

recommendation (with regard to innovative nature of business), in a format

specified by DIPP, from an incubator established in a post-graduate college in

India; or

o

be supported by an

incubator which is funded (in relation to the project) from GoI as part of any

specified scheme to promote innovation; or

o

be supported by a

recommendation (with regard to innovative nature of business), in a format

specified by DIPP, from an incubator recognized by GoI; or

o

be funded by an

Incubation Fund/Angel Fund/Private Equity Fund/Accelerator/Angel Network duly

registered with SEBI* that endorses innovative nature of the business; or

o

be funded by the

Government of India as part of any specified scheme to promote innovation; or

o

have a patent

granted by the Indian Patent and Trademark Office in areas affiliated with the

nature of business being promoted.

* DIPP may publish a negative list of funds which

are not eligible for this initiative.

START-UP INDIA

4) Registration of Start-up

Option

1:

An entity can register itself

through MCA or Registrar of Firms using the existing processes and subsequently

register itself on the Start-up India portal and mobile app as a Start-up to

avail the benefits.

Option

2:

An entity can register itself

through the Start-up India portal and mobile app using a seamless process. This

facility would be made available in the second phase of the Start-up India

portal and mobile app launch.

1.

Log in to Start-up India Portal

2.

Choose your legal entity

3.

Input your

incorporation/registration number

4.

Input your

incorporation/registration date

5.

Input PAN number (optional)

6.

Input your address with postal code

& state

7.

Input authorized representative

details

8.

Input director(s)/partner(s) details

9.

Choose and upload supporting

documents and self-certification

10.

Incorporation/registration

certificate of company/LLP/Partnership

11.

Registration to avail tax and IPR

12.

Certify the official notification

terms and conditions